- Wealth Habits

- Posts

- Market & Economic Observations | Portfolio Changes | Operations Update

Market & Economic Observations | Portfolio Changes | Operations Update

2023 2nd Half Update

Are we on the verge of a recession?

Confused by the Conflicting Economic Data?

The economic landscape is shifting, and there's a palpable concern that mounting interest rates are squeezing the consumer to the point of a recession. In addition to curbing inflation and stabilizing the price environment, high interest rates also increase borrowing costs for consumers and companies.

However, it's important to note that the economic signals are not unidirectional. Amidst these challenges, there are also streams of data pointing towards a continued expansion within the economy.

Certain sectors are showing resilience, and consumer spending, albeit more cautious, continues to contribute to economic growth. Employment rates have remained robust in several industries, underpinning the economic momentum.

It's a complex tapestry of economic indicators we are examining, and while the risk of a downturn looms, the possibility of enduring economic expansion cannot be dismissed.

Time will reveal the true trajectory of our economy. My role is to navigate these uncertain waters with caution, staying informed and agile in our strategies.

What is happening with interest rates?

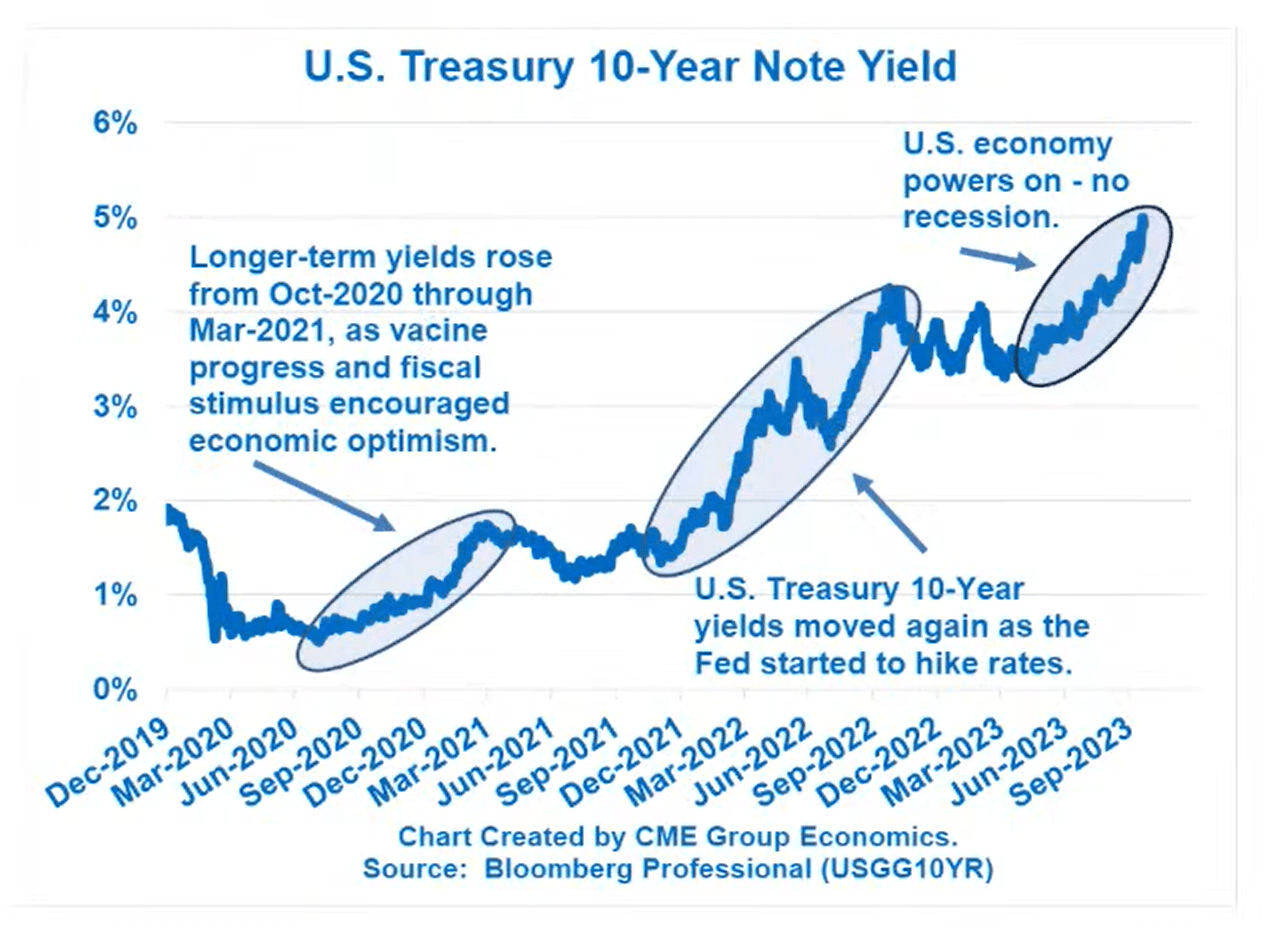

The Federal Reserve raised interest rates sharply from March 2022 through this summer as it tried to get inflation under control. Inflation had hit 40-year highs in mid-2022, peaking at 9.1% annually.

Every move upwards in interest rates causes stress in the equity markets. The 10-year Treasury yield recently reached 5%, the highest since 2007. However, on November 1st, Powell left interest rates unchanged, mentioning that rising yields on the long-end of the Treasury curve are doing some of the central bank’s work.

Investors have been anxious about this increase in yields, despite it presenting a potential investment opportunity. Bond prices have dropped significantly over the past two years (inversely to yields).

At the time of writing this, The Bloomberg US Aggregate Bond Index has gained almost 3.5% this year, finally ending its two year consecutive drop. The index experienced a record 13% loss last year, surprising many investors.

Market & Economic Observations

Market & Economic Summary

In October, the S&P 500 experienced a drop, driven by comments from Federal Reserve Chair Jerome Powell regarding possible adjustments to rate policies.

Powell indicated that rates might remain elevated until inflation meets the central bank's 2% goal, causing concern among investors. This unease was exacerbated by some Q3 company financials showing increased costs.

The S&P 500 had climbed in the first half of the year on optimism that the Federal Open Market Committee would stop raising rates. While there have been pauses, investors are now bracing for another increase after the policy-setting committee lifted its median rate outlook last week for 2024 and 2025. Worries about this have fueled the index's recent declines.

Millions of Americans started making payments again on their federal student loans, after a pandemic-era pause for over three years.

Oil prices surged in the third quarter as U.S. crude-oil futures closed at about $91 a barrel September 29th, up nearly 30% from $71 at the start of July when cuts made by OPEC and its allies lowered global supplies below demand. Prices have rallied above $100-a-barrel, raising the possibility of inflation pressures and central bank action.

Will There Be A Soft Landing?

There is a debate going on right now. The question is whether we will have a hard recession, soft landing, or just a simple slowdown. To me, the recession case is guaranteed to be right... eventually. In the meantime, “eventually” could happen very quickly, while at the same time, “eventually” could be years from now.

The timeframe appears to have been pushed out due to huge influx of stimulus (Inflation Reduction Act, CHIPS and Science Act, and the Infrastructure Investment and Jobs Act).

While timing these sorts of things is impossible, there are a few positive factors that should be considered:

Consumer spending has somehow remained resilient.

The labor market remains strong.

Inflation has clearly cooled.

Mortgage delinquencies remain low.

Factory orders have started to recover.

The banking crisis appears to be contained.

On the other hand:

Consumers continue to rely heavily on credit card debt, which has risen rapidly, while delinquent balances have returned to historical levels. This trend is unsustainable.

Labor markets are turning. Full-time employment levels are starting to decrease while part-time continues to grow.

Gasoline demand is fell of a cliff in October 2023

We’ve had an inverted yield curve for quite some time and those yield curve inversions predict recessions well.

Existing home sales have been frozen due to rising mortgage rates

US manufacturing PMI has been contracting for almost 11 months.

Growing probability that our government shuts down due to political disagreements.

Banks remain stressed and their balance sheets will come under more stress as the yields continue to rise.

When it comes to volatility, it's bound to come back. Market history has shown that a few mega-cap stocks cannot dominate the market forever. As interest rates have done in recent years, it is inevitable that the pendulum will swing back towards a more balanced market structure.

Predicting the economic cycle with certainty is tough due to the delayed effects of Fed policy and the fact that financial markets often anticipate economic trends. I believe it's better to focus on areas where market expectations seem too high, posing future risks, and areas where they're too low, offering potential for good long-term returns.

Portfolio Actions - Passive Portfolios

Passive Portfolio Actions (Year-to-Date)

In the face of rising interest rates and declining inflation, it seems logical to tilt our allocation towards fixed income.

Considering the risk of rising interest rates, I intend to increase the allocation to fixed income with maturities between 2 and 5 years at the expense of shorter maturities. This is a tactical move and should reverse after rates peak.

Why the Era of Historically Low Interest Rates Could Be Over

Higher productivity and increased deficits could raise the ‘neutral’ rate of interest.

Ultralow interest rates may not return soon, as pre-pandemic levels are not anticipated by policymakers. The Federal Reserve, maintaining rates at a 20-year high, hints at potential further increases this year.

The Fed’s own economic projections indicate a ceiling for rate hikes, but also suggest sustained elevated future borrowing costs. Rates might hover above 5% in the upcoming year and are projected to be around 4% by 2025—about double the rates of late 2019.

Portfolio Actions - Active Portfolios

Active Portfolio Actions (Year-to-Date)

In this section, I’m just informing you what I did in my portfolios. Obviously, you should do your own research. The below is just information.

We sold our positions in ABBV, DLO, KRE, and LH

We begin positions in ATRK, TMO, ZBRA.

Rationale

ABBV - Their patent for the blockbuster drug Humira expired. They are fighting in court to protect other patents around the production of the drug. Margins will eventually contract for this drug and this will be a headwind.

ATKR - We made a substantial investment in Atkore across most portfolios. Atkore is a global manufacturer recognized for providing electrical, safety, and infrastructure solutions. They manufacture products like Electrical Conduit and Fittings, Cable and Cable Management Systems, among others, which are used worldwide for power and protection applications. The transition to a more modern infrastructure, especially with an emphasis on safety and electrical solutions will benefit Atkore as there will be a higher demand for their products and solutions. CD&R (Private Equity) used to own them before their IPO in 2016. CD&R appears to have instilled a strong shareholder-friendly capital allocation culture at Atkore. The management has a track record of effective capital allocation through mergers & acquisitions (M&A) and share buybacks. They've been able to acquire companies at reasonable valuations, grow the businesses long term, and have significantly reduced the share count since its 2016 IPO, thereby demonstrating a focus on enhancing shareholder value which aligns with an emphasis on ROIC (Return On Invested Capital)

DLO - DLocal is a technology company that specializes in providing cross-border payment solutions and payment processing services for businesses operating in emerging markets. The stock surged after they announced a new co-CEO to lead the company as it scales. We exited because it hit my target price.

KRE - Banks continue to face challenges and headwinds despite solid revenue and profit growth in the second quarter. Problems in the industry, such as declining valuations for legacy bonds and a potential credit crisis, have worsened as interest rates continue to rise. The stabilization of interest rates will likely bring a quick rebound to this industry.

LH - The primary focus for Labcorp remains its transition out of the post-COVID phase. Like many healthcare entities, its sales and cash flows have significantly retreated post-pandemic. LH undoubtedly holds a strong market position with excellent core offerings. However, from a valuation point of view, it seems expensive to own.

TMO - Thermo Fisher's long-term outlook appears promising. Its strategic positioning within the healthcare industry, along with its capability to adeptly navigate complex market dynamics, underscores its potential for outperformance.

ZBRA - Zebra provide solutions that assist companies in automatically identifying, tracking, and managing their resources. To give you a clearer picture: think about devices like mobile computers, barcode scanners, RFID readers , and specialized printers that produce barcode and RFID labels. Recently, the company reported disappointing Q2 and full-year guidance, with FY23 revenue expected to drop 20-23% year-over-year due to post-pandemic demand normalization. Particularly, retail and logistics sector customers are delaying new purchases as they adjust to their capacities. Looking past the cyclical hiccup, we believe Zebra’s growth is not being reflected in its current valuation. With America’s manufacturing construction activity at historically high levels, it should be a matter of time before spending trickles down to supply chain investments and new equipment purchases.

Financial Planning Reminders

Below are some topics to discuss with your financial advisor before the year-end

Tax Planning: Discussing any potential tax-saving strategies before the year-end, such as tax-loss harvesting, maximizing contributions to retirement accounts, or charitable giving.

Investment Review: Reviewing your investment portfolio performance, discussing any needed rebalancing, and considering any strategic changes based on market conditions or economic forecasts.

Retirement Planning: Assessing whether you are on track with their retirement savings goals and making any necessary adjustments to contributions or investment strategies.

Budgeting and Cash Flow Planning: Reviewing your budget and cash flow, setting goals for the upcoming year, and planning for any significant expected expenses.

Year-End Bonuses and Compensation: Discussing how to best allocate year-end bonuses, whether to invest, pay down debt, or save for future expenditures.

Required Minimum Distributions (RMDs): If applicable, making sure that anyone over age 72 take their RMDs from retirement accounts to avoid penalties.

Gifting Strategies: Discussing any plans for gifting to family members or charities, including the use of annual gift tax exclusions.

New Year's Financial Resolutions: Setting financial resolutions for the new year and establishing a plan to achieve them.

Regulatory or Legislative Changes: Informing you about any recent or upcoming regulatory or legislative changes that could affect your financial planning.

Below are some topics to review if there was a life change

Estate Planning Updates: Reviewing and updating estate planning documents, such as wills, trusts, healthcare directives, and powers of attorney, if necessary.

Insurance Review: Evaluating current insurance coverage, including life, disability, long-term care, and property and casualty insurance, to ensure adequate protection.

Educational Planning: For someone with children or grandchildren, discussing savings strategies for education expenses, such as 529 plans.

Beneficiary Designations: Ensuring that all accounts with beneficiary designations (like IRAs, 401(k)s, and insurance policies) are up to date.

Operations Update

As part of my effort to keep you up to date about my business, I want to let you know about a couple of updates.

Over the past two years, internal operating costs have increased substantially. One significant factor is the rise in software subscriptions.

Some providers, like Ycharts, have increased their prices significantly, which is why I've opted not to renew our subscription with them. I've found a good replacement called Koyfin.

I recently subscribed to Holistiplan, which automates the tax planning process by helping me review tax returns and generate actionable planning points swiftly.

I also subscribed to Income Lab, which is a retirement distribution tool focused on helping advisors calculate the most efficient deccumulation strategies. In other words, it helps me answer the following question: how much should I distribute from each retirement account per year? How do I tax optimize my retirement distributions? (e.g. IRA, 401k, taxable brokerage, Roth IRA, etc.)

Thank You

As we close this month's edition, let's remember that financial well-being is not just about the numbers on a spreadsheet or the balance in an account. It's about the peace of mind that comes from knowing you're on the right path, the confidence to face life's uncertainties, and the freedom to pursue your passions.

In the ever-evolving landscape of finance, our commitment remains steadfast: to empower and guide you towards a brighter financial future. Until next time, stay informed, stay proactive, and most importantly, stay inspired.